1×1 Media

Founder’s Pocket Guide: Raising Angel Capital

ISBN: 978-1-938162-10-7

$3.99 eBook

$7.99 paperback

Review the Complete Process. This concise guide gives entrepreneurs a complete overview of the angel funding process, answering the most frequent questions entrepreneurs face as they build new companies.

Save Time and Avoid Pitfalls. If you are new to the startup funding process and need to raise angel capital, start with this book. It strips away nonessentials and provides you with fundamental, easy-to-reference information so you can move on to building your venture. Concise explanations help you understand angel investor expectations so that you can go into investment discussions prepared and knowledgeable.

- Is my startup really “investor ready”?

- How much can my startup legally raise?

- How much equity should I give up to investors?

- How much money is realistic to raise from angels?

- What is a pre-money valuation and how can I determine the right amount?

- What do terms such as dilution, convertible debt, and cap table mean?

- What is a term sheet, and how does it affect an investment deal?

- What is the difference between preferred shares and common shares?

- What stage does my startup need to be at to be interesting to angel investors?

Table of Contents

1. Understanding Angel Investors

- Angels Have Made Their Wealth in Many Ways

- Angels Invest in Growth Segments

- Why Angels Invest

- Independent Angels

- Organized Angel Groups

- Benefits of Working with Organized Angels

- Downsides of Working with Organized Angel Groups

- Angels vsVCs: It’s Their Money

- Deal Syndication and Sidecars

- Accredited Investor Status

- Finding Angel Investors

- Exit Expectation: How Investors Get Their Money Back

- Vetting Prospective Angel Investors

2. What Attributes Do Angels Want in a Startup?

- Great Teams

- Large Target Market Size

- Disruptive Technology or Ideas

- Customer Traction

- Defensible IP or Market Position

- High Growth Potential (Three to Five Years)

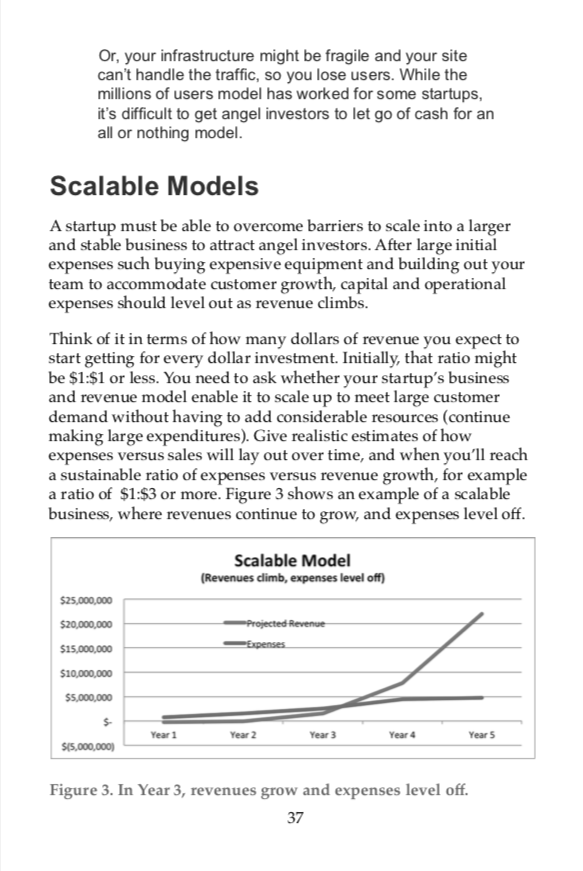

- Scalable Models

3. Startup Stages and Angel Investment

- Idea Stage

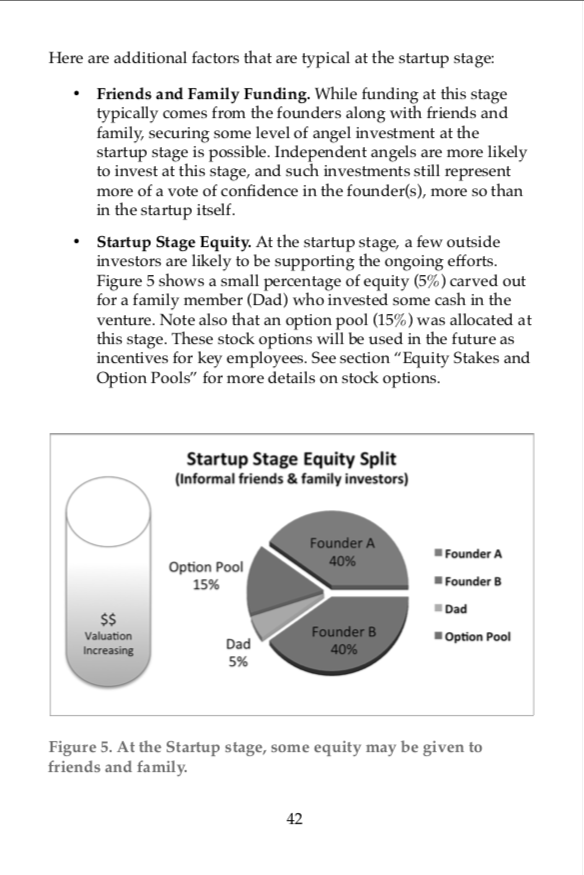

- Startup Stage

- Traction Stage

- Growth Stage

4. Setting Your Funding Target and Plan

- Determining How Much to Raise

- Distilling a Funding Plan

- Raise Amount and Multiple Angels

- Raising Too Little Money

- Raising Too Much Money

- Arriving at a Valuation

- Valuation Relative To How Much to Raise

- Equity Stakes and Option Pools

5. The Angel Funding Process

- Stage 1: Introduction to Angels

- Stage 2: The Pitch

- Stage 3: Due Diligence

- Stage 4: Investment .68

- Stage 5: Keeping Investors Updated

- How Long Does It Take to Raise Money?

6. Is Your Startup “Investor Ready”?

- Business Plans

- Your Funding Pitch and Pitch Deck

- Your Business Model and Revenue Model

- Marketing and Marketing Calendar

- Sales Process and Sales Pipeline

- Financial Projections

- Funding Needs and Uses

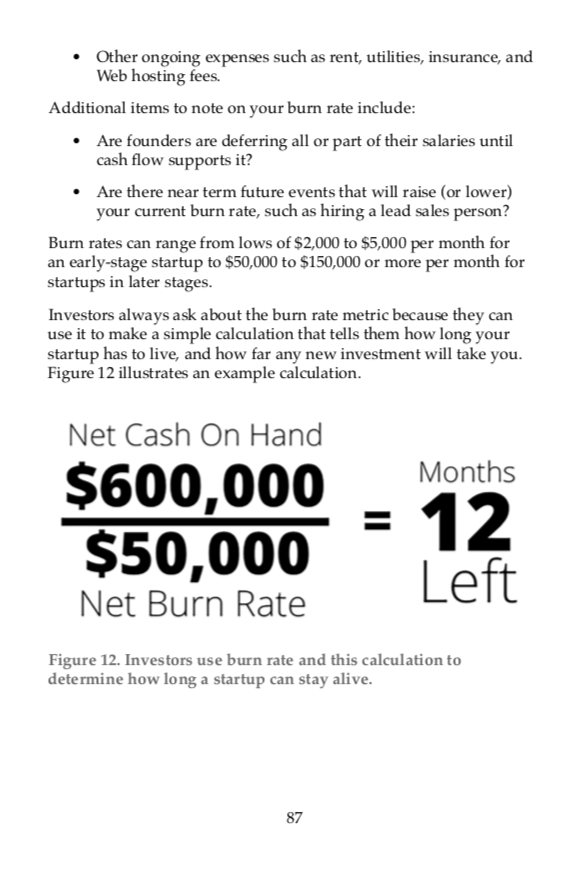

- Staying Alive: Burn Rate

- Market Size

- Competition

- Patents and Other IP

- Valuation

- Is Your Startup Housekeeping Done?

7. Building Your Startup Funding Knowledge Base

- Understanding Startup Funding Speak

- Equity and Debt Basics

- Dilution and Ownership Math

- Understanding Fully Diluted Shares Outstanding

- Preferred Shares versus Common Shares

- Convertible Debt

- Restricted Stock

- Cap Tables

- Term Sheets

- Early-stage Startup Valuation

- Legal Documents Pertaining to Angel Funding

- Advisors and Board of Directors

- SEC Rules of Startup Funding

What People are Saying

“Very detailed and easy to understand.”

E. S.

Related Books

Startup Valuation

This guide provides a quick reference to all of the key topics around early-stage startup valuation and provides step-by-step examples for several valuation methods.

Term Sheets

This easy to follow guide helps startup founders understand the key moving parts of an investment term sheet, and review typical preferred share rights, preferences, and protections

Cap Tables

This highly visual guide helps you understand the key moving parts of a startup cap table, review typical cap table inputs, and demystify terminology and jargon associated with cap table discussions.