1×1 Media

Founder’s Pocket Guide: Terms Sheets and Preferred Shares

ISBN: 978-1-938162-06-0

$3.99 ebook

$7.99 paperback

This easy to follow guide helps startup founders understand the key moving parts of an investment term sheet and reviews typical preferred share rights, preferences, and protections. Along the way, it also provide easy-to-follow examples for the most common calculations related to preferred share equity deals.

In more detail, this Founder’s Pocket Guide helps startup founders learn:

- What a term sheet is and how to summarize the most important deal terms for your fundraising and startup building goals.

- How preferred stock shares differ from common shares, with a review of how each key preferred share right and preference is tied to the investor’s shares.

- Key terms and definitions associated with equity fundraising, such as pre-money valuation, founder dilution, and down round.

- How to decipher legalese associated with a term sheet deal, such as pro rata, fully diluted, and pari passu.

- The full list of the most common term sheet clauses, their plain English meaning, and their importance to an early-stage investment deal.

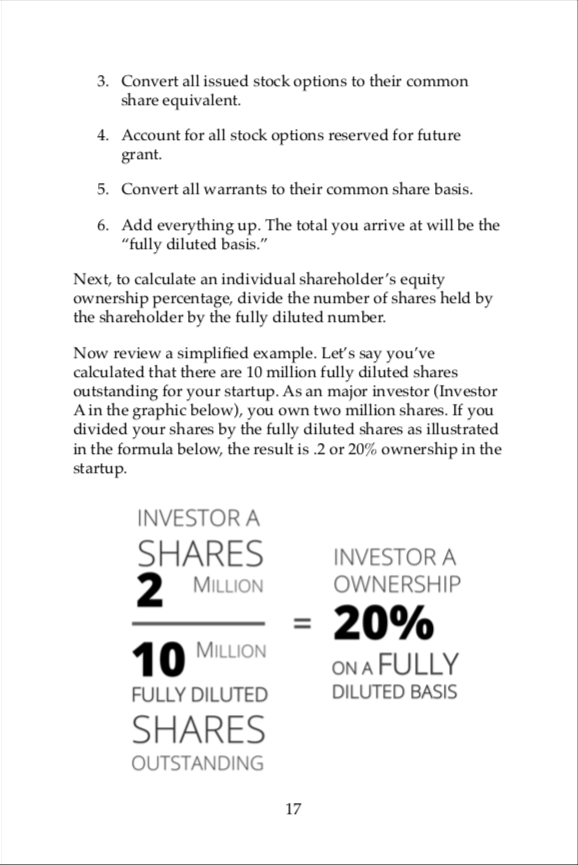

- Simple math for the key term sheet financial aspects, including calculating fully diluted shares outstanding, investor equity ownership percentages, and the impact of option pools on founder dilution.

- Example exit scenarios, showing how term sheet deal points impact how exit proceeds get divided among investors and founders.

Table of Contents

1. Term Sheets Basics

- What is a Term Sheet?

- Understanding Share Types

- Preferred Shares

- Common Shares

- Specific Term Sheet Terminology

- Fully Diluted

- Pro Rata

- Startup Funding Terminology

2. Deconstructing a Term Sheet

- Financial Term Sheet Parameters

- Type of Security

- Investment Amount

- Pre-Money Valuation

- Price Per Share

- Number of Shares

- Conversion

- Dividends

- Cumulative Dividends

- Non-Cumulative Dividends

- Liquidation Preference

- Non-Participating Preferred

- Participating Preferred

- Participating Preferred with a Cap

- Converting to Common

- Option Pools

- Anti-Dilution

- No Anti-Dilution Protection

- Full Ratchet Anti-Dilution

- Weighted Average Anti-Dilution

- Pay to Play

- Warrants

- Legal Fees

3. Governance and Control Investor Rights

- Right of First Refusal and Co-Sale Rights

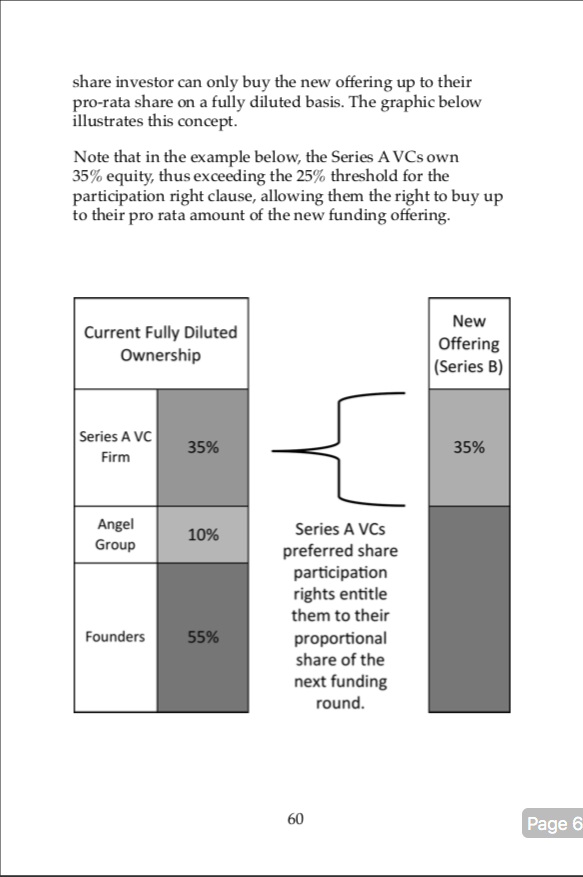

- Participation Rights

- Registration Rights

- Board Representation

- Voting Rights

- Information Rights

- Drag Along Rights

- Protective Provisions

- Pari Passu

- Exclusivity

- Confidentiality

- Conditions of Financing

- Founder Vesting and Restricted Stock

- Insurance

- Founder Employment Agreements

- Invention Assignment

What People are Saying

“A practical guide for startup founders.”

L. Arango

“Puts terms in Plain English.”

M. Budzynski

“Five Stars!”

M. Smith

Related Books

Angel Funding

This concise guide gives entrepreneurs a complete overview of the angel funding process, answering the most frequent questions entrepreneurs face as they build new companies.

Equity Splits

“How do we split the equity ownership of our startup?” This guide provides a framework and process to help startup founders answer this common question.

Convertible Debt

This easy to follow guide helps startup founders understand the key moving parts of the convertible debt funding structure and serves as an easy reference for the most common terms and calculations related to convertible debt.