1×1 Media

Founder’s Pocket Guide: Startup Valuation

ISBN: 978-1-938162-04-6

$3.99 ebook

$7.99 paperback

This updated edition includes several new features, including:

- The Startup Valuation Explorer

- Expanded coverage of valuation methods

- Responses to investor questions about your valuation

- Details about option pool impact on your valuation

For many early-stage entrepreneurs assigning a pre-money valuation to your startup is one of the more daunting tasks encountered during the fundraising quest. This guide provides a quick reference to all of the key topics around early-stage startup valuation and provides step-by-step examples for several valuation methods.

- What a startup valuation is and when you need to start worrying about it.

- Key terms and definitions associated with valuation, such as pre-money, post-money, and dilution.

- How investors view the valuation task, and what their expectations are for early-stage companies.

- How the valuation fits with your target raise amount and resulting founder equity ownership.

- How to do the simple math for calculating valuation percentages.

- How to estimate your company valuation using several accepted methods.

- What accounting valuation methods are and why they are not well suited for early-stage startups.

Download the Valuation Explorer File

Table of Contents

1. In This Pocket Guide

- Founder Pro Tips

- Download the Startup Valuation Explorer

2. Valuation Fundamentals

- How to Think About Startup Valuation

- Valuation Increases at Each Funding Stage

- Valuation and Funding Terminology

- When to Worry About Valuation

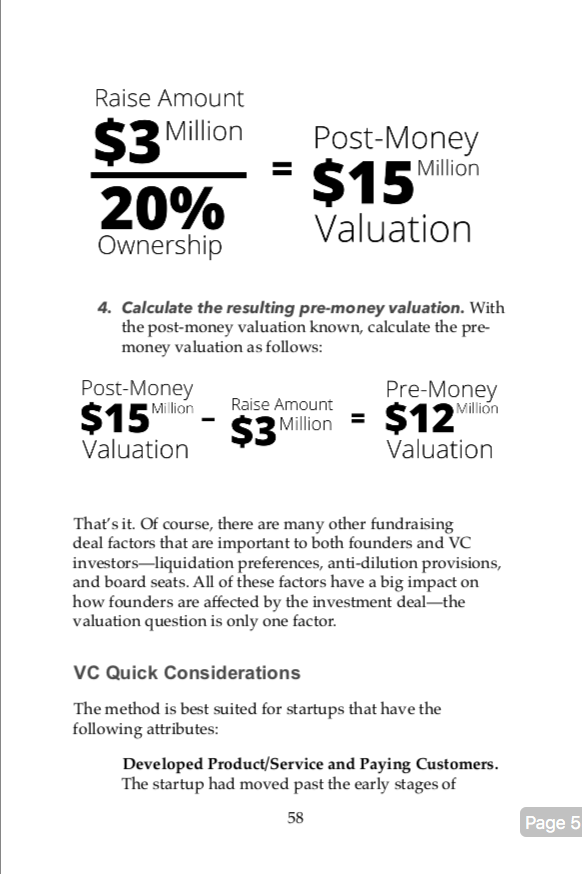

- The Basic Valuation Equation

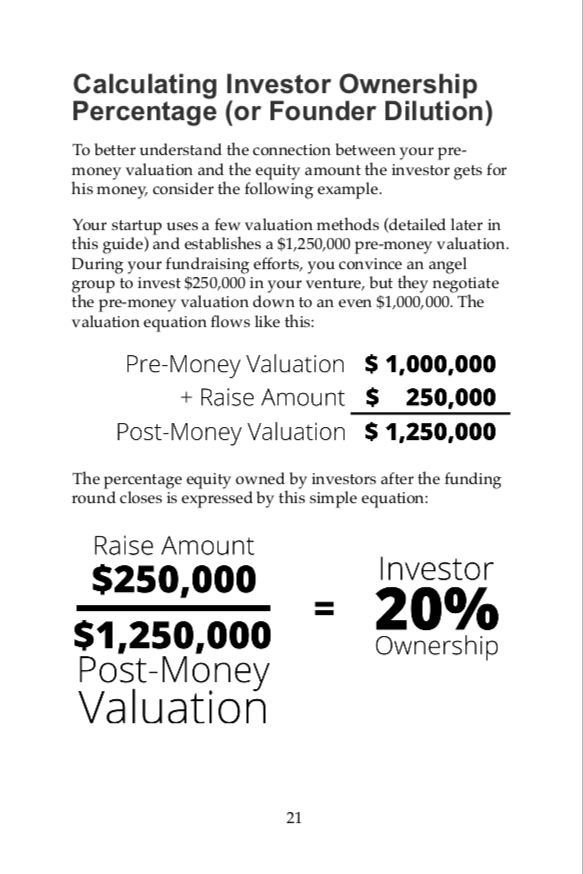

- Calculating Investor Ownership Percentage

- Expressing Your Valuation to Investors

- Valuation and Raise Amount Sanity Check

- Early-Stage Valuation Pitfalls

- What is a Down Round?

- Determining Early Stage Valuations

3. Early Stage Valuation Methods

- The Market Comp Valuation Method

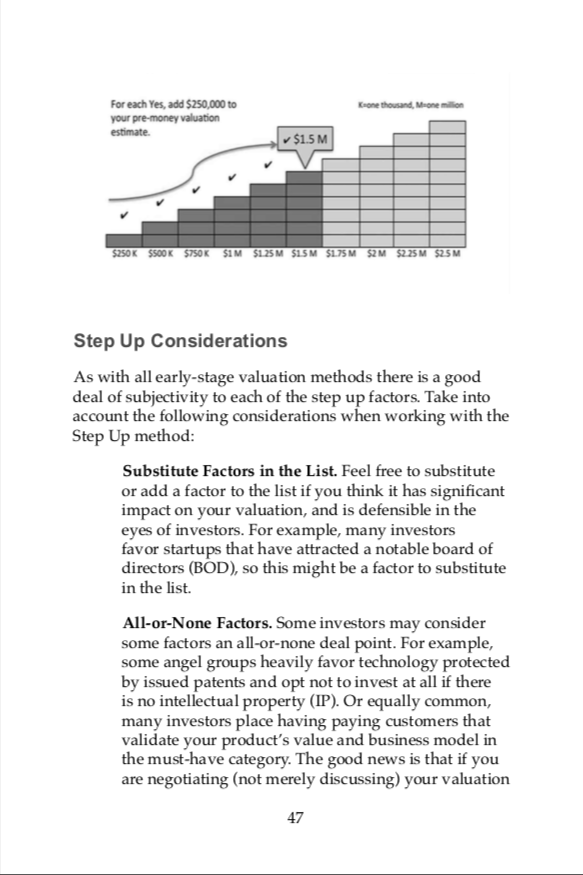

- The Step Up Valuation Method

- Risk Mitigation Valuation Method

- The VC Quick Valuation Method

- The VC Valuation Method

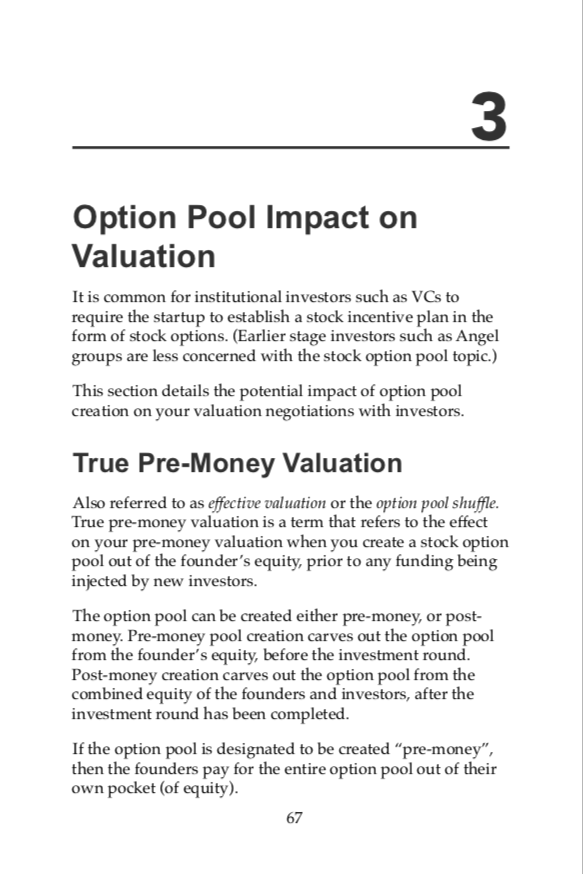

4. Option Pool Impact on Valuation

- True Pre-Money Valuation

- True Pre-Money Valuation Math

5. Responding to Investor Valuation Questions

- Your Valuation Is Too High

- Your Revenues Don’t Support Your Valuation

- You’re Too Early

6. Understanding Accounting Valuation Methods

- Quantitative Valuation Models

- Accounting Valuations Distilled

- Understanding 409A Valuations

What People are Saying

“A Great Find”

JP.

“Fast and informative”

C. Anderson

“Simple, useful, to the point!”

W. Browne

Related Books

Stock Options

This highly visual guide offers startup founders and employees a “nuts and bolts” view of how stock options and other forms of equity compensation work in early-stage startups.

Term Sheets

This easy to follow guide helps startup founders understand the key moving parts of an investment term sheet, and review typical preferred share rights, preferences, and protections

Cap Tables

This highly visual guide helps you understand the key moving parts of a startup cap table, review typical cap table inputs, and demystify terminology and jargon associated with cap table discussions.