1×1 Media

Founder’s Pocket Guide: Friends and Family Funding

ISBN: 978-1-938162-11-4

$3.99 ebook

$7.99 paperback

Structure deals correctly. Getting the money in the bank is a big step, but doing it the right way matters even more. This book provides easy to follow guidance for choosing and documenting the best funding structures for both your startup and your funding partners. As an added bonus, a promissory loan example is provided, with blow by blow details of each clause.

- Structuring a simple startup loan with friends and family lenders.

- Using convertible debt to entice friends and family to invest in your startup.

- Learning the most important considerations for issuing stock to friends or family members.

- Understanding the legal limits of raising startup capital from friends and family.

- Keeping early funding rounds clean for later stage investors such as angels and VCs.

- Using profit sharing to rewarding friends and family investors for backing your startup.

Table of Contents

1. Understanding Startup Funding Terminology

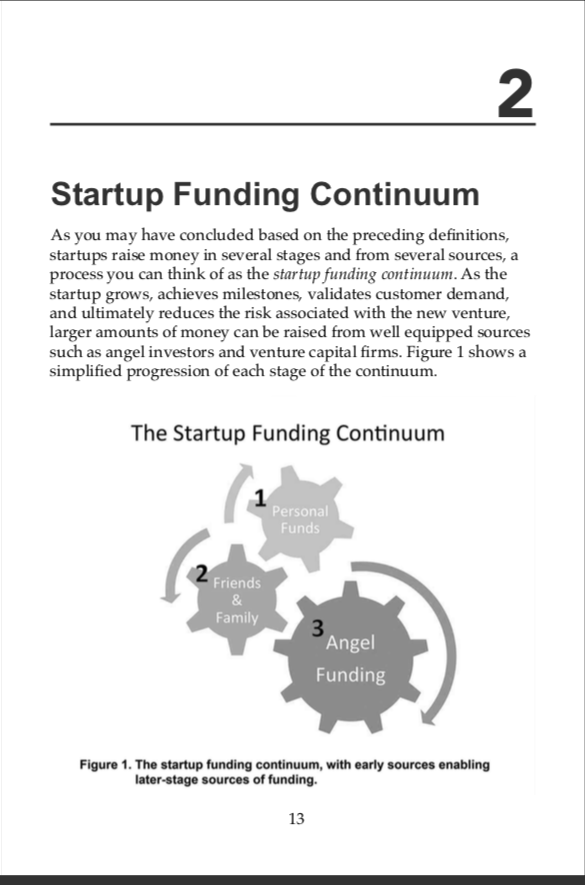

2. The Startup Funding Continuum

3. How Much to Raise from F&F Sources

- What Kind of Startup Are You Creating?

- Estimating Your Funding Needs

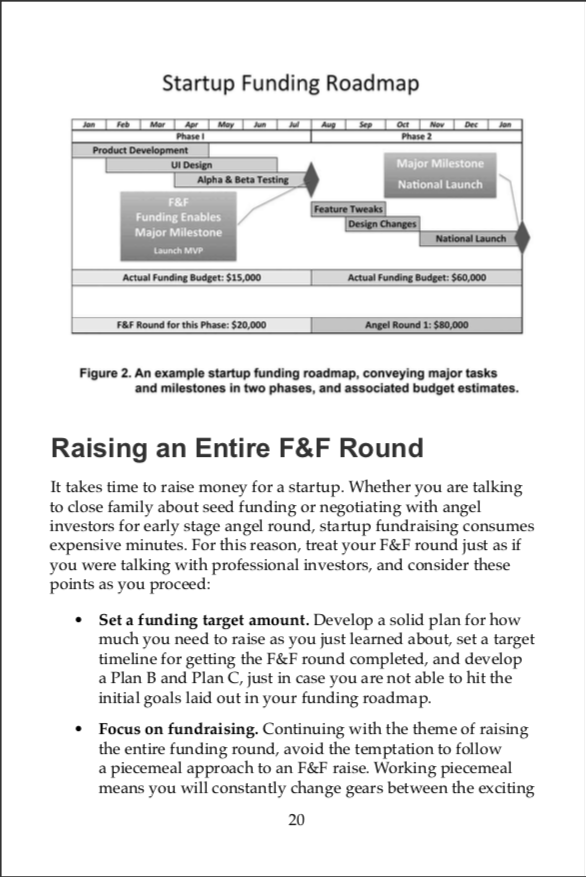

- Raising an Entire F&F Round

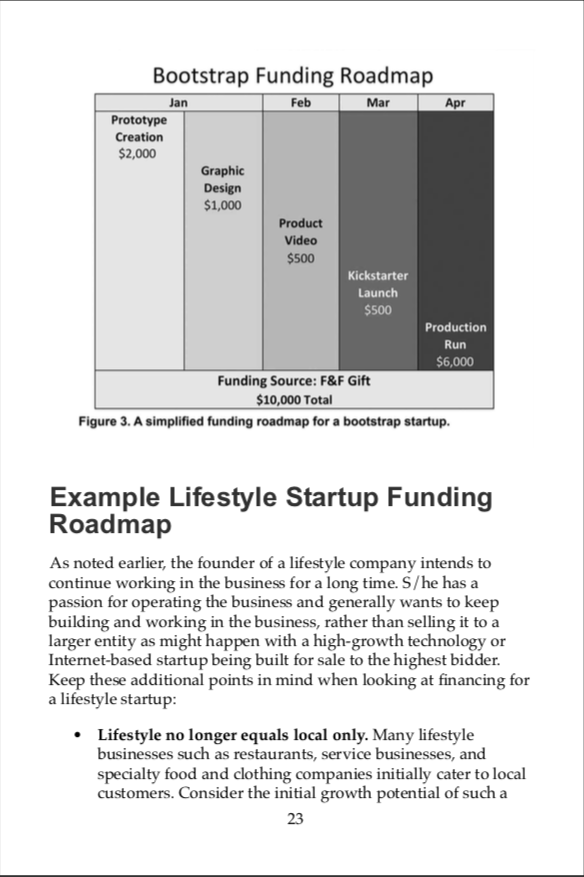

- Example Bootstrap Startup Funding Roadmap

- Example Lifestyle Startup Funding Roadmap

- Example High Growth Startup Funding Roadmap

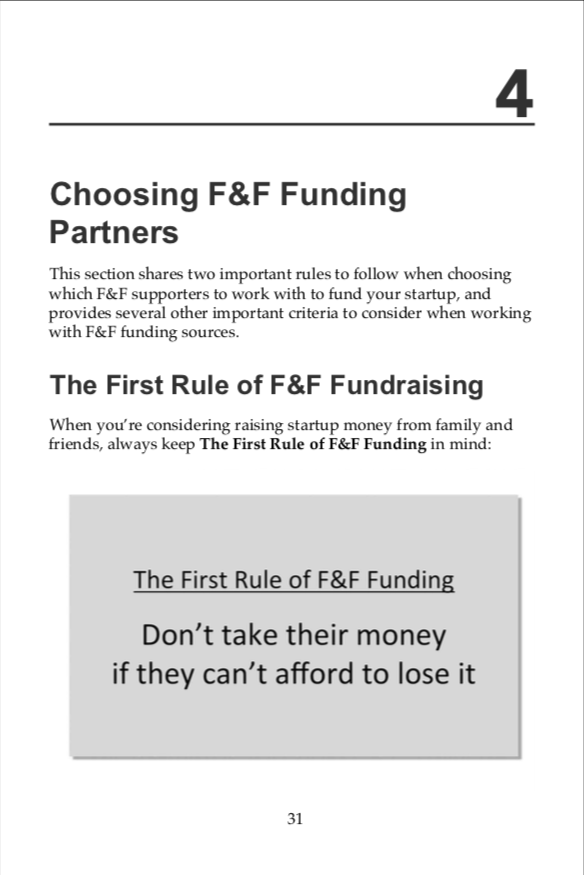

4. Choosing F&F Funding Partners

- The First Rule of F&F Fundraising

- The Second Rule of F&F Funding

- Don’t Take Money from F&F If Special Action Is Needed

- Active Verses Passive Investors

- Creating an Ideal FF Investor Profile

- Raising Startup Capital from Several F&F Investors

5. Incorporating and F&F Money

- Do You Need To Incorporate To Take F&F Money?

- Other Incorporation Triggers

- Additional Benefits to Incorporating

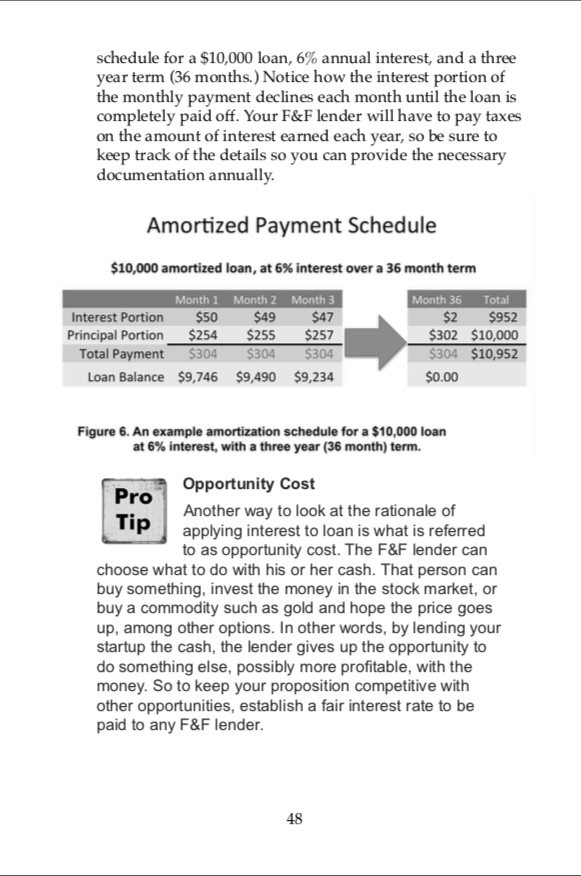

6. F&F Loan Mechanics

- Loans Are a Good Funding Option

- Loans 101

- Setting Up a Simple Loan from a F&F Lender

- Loan Tax Implications

- Paying Off a Loan Early

7. F&F Profit Sharing Agreements

- Where To Dip In and Share Profits

- How Much Profit Should You Share?

- When To Start Paying Out a Profit Share

- Setting a Limit To Profit Sharing

- Combining Profit Sharing with Other Forms of Funding

8. Startup Equity: What is Equity

- Understanding Startup Company Valuation

- Dilution and Ownership Math

- Preferred Shares Versus Common Shares

- Keeping It Legal Under Reg D

- Should F&F Become Equity Shareholders?

- If You Give Up Equity, How Much?

- Selling equity to F&F

9. More F&F Funding Options

- Funding Your Startup with a F&F Gift

- F&F Underwriting a Traditional Bank Loan

10. How to Pitch Friends and Family

- The Casual Pitch to Family or Close Friends

- A Structured or Traditional F&F Pitch

- The “Ask”

11. Keeping Your Investors Up to Date

- The Third Rule of F&F Fundraising

- Provide Written Updates

- What To Report—The Short List

12. Appendix: An Example Promissory Note

- A Simple Loan Promissory Note, Blow by Blow

What People are Saying

Friendly Reading…

R. Raul

“Priceless information!”

D.M.

“Great!”

to get your first capital investment and how to manage it in the legal and personal contexts.”

A. Alacon

Related Books

Angel Funding

This concise guide gives entrepreneurs a complete overview of the angel funding process, answering the most frequent questions entrepreneurs face as they build new companies.

Equity Splits

“How do we split the equity ownership of our startup?” This guide provides a framework and process to help startup founders answer this common question.

Convertible Debt

This easy to follow guide helps startup founders understand the key moving parts of the convertible debt funding structure and serves as an easy reference for the most common terms and calculations related to convertible debt.