1×1 Media

Founder’s Pocket Guide: Stock Options and Equity Compensation

ISBN: 978-1-938162-14-5

$3.99 eBook

$7.99 Paperback

Throughout this guide numerous mini-infographics illustrate the key concepts founders need to know and show the relationships between stock option grants, vesting timelines, exercise timing, and associated tax implications.

Startup Equity Compensation Basics

The first section of this guide is structured to help founders build a base of understanding about the numerous definitions and terminology related to startup equity compensation and stock options. Topics covered include:

- A brief refresher on startup equity in preparation for delving into the details of stock options and other forms of equity compensation.

- A quick review of how startup equity ownership is shared between the various stakeholder of a startup including the founders, investors, and employees.

- The fundamental mechanics of how startup stock options work, including option grants, exercising, vesting, and selling of stock shares.

- A detailed review of equity compensation terminology and definitions, such as vesting, strike price, fair market value, and spread.

- An explanation of each of the most common types of equity compensation including Restricted Stock, Incentive Stock Options, Non-Qualified Stock Options, and Restricted Stock Units.

Equity Compensation Types in Detail:

The next section of this guide reviews each of the most common types of equity compensation, including detailed components such as tax implications, vesting and exercise parameters, and other IRS rules governing the ownership of each equity type. The following equity compensation types are covered:

- Restricted Stock (RS)

- Incentive Stock Options (ISOs)

- Early Exercise Incentive Stock Options (EE-ISOs)

- Nonstatutory Stock Options (NSOs)

- Early Exercise Nonstatutory Stock Options (EE-NSOs)

- Restricted Stock Units (RSU)

Establishing Your Startup’s Equity Plan:

In the final part of this guide we dig deeper into the key areas founders need to consider when developing an equity plan for their startup, with specific focus on the following issues:

- When to implement a formal equity incentive plan.

- What factors to consider when deciding how large the equity compensation pool should be.

- How to decide employee equity award amounts at the different stages of a startup’s lifecycle.

- What general steps to take to establish a equity compensation plan for your startup.

- What key information that must be communicated to employees about equity compensation awards.

- Which step-by-step calculations are needed to truly understand equity ownership percentages and value.

- How IRS and SEC rules impact private company equity compensation.

Table of Contents

1. In This Pocket Guide

- Founder Pro Tips

- Download the Equity Compensation Companion File

2. How this Guide is Structured

- Startup Equity Compensation Basics

- Equity Compensation Types in Detail

- Establishing Your Startup’s Equity Plan

- What this Guide Does Not Cover

3. Startup Equity Compensation Basics

- Cutting Up the Pie: How a Startup Divides Equity

- Stock Options: An Equity Compensation Timeline

- Establishing an Option Pool

- Establishing the Exercise Price (Strike Price)

- Providing an Equity Stake: Equity Grants

- Earning Shares: Vesting

- Buying Shares: Exercising Options

- Leaving the Company: Golden Handcuffs

- Cashing Out: Selling Shares

- Equity Timeline Example

4. Understanding Vesting Methods

- Time-Based Vesting

- Milestone-Based Vesting

- Back-Weighted Vesting

- Vesting Acceleration

- Single Trigger Acceleration

- Double Trigger Acceleration

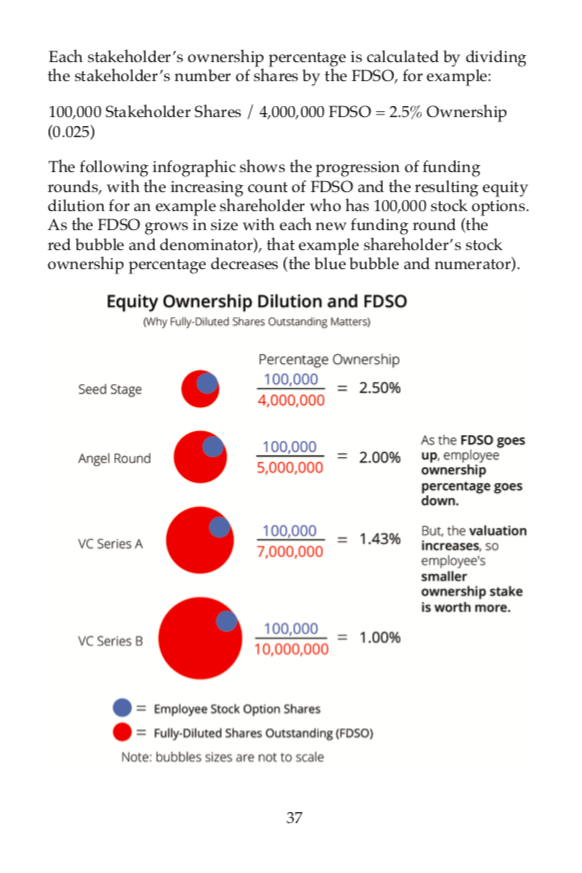

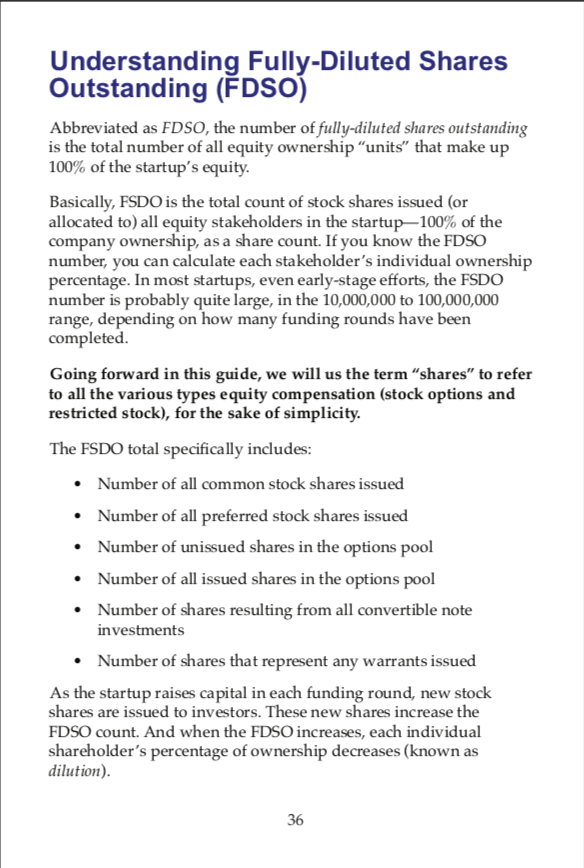

5. Understanding Fully-Diluted Shares Outstanding (FDSO)

6. VC Valuation and VC Price Per Share

7. Understanding Fair Market Value (FMV)

8. Comparing FMV Share Price and VC Price Per Share

9. Understanding 409A Valuations

10. In the Money Options and Underwater Options

11. Understanding Spread

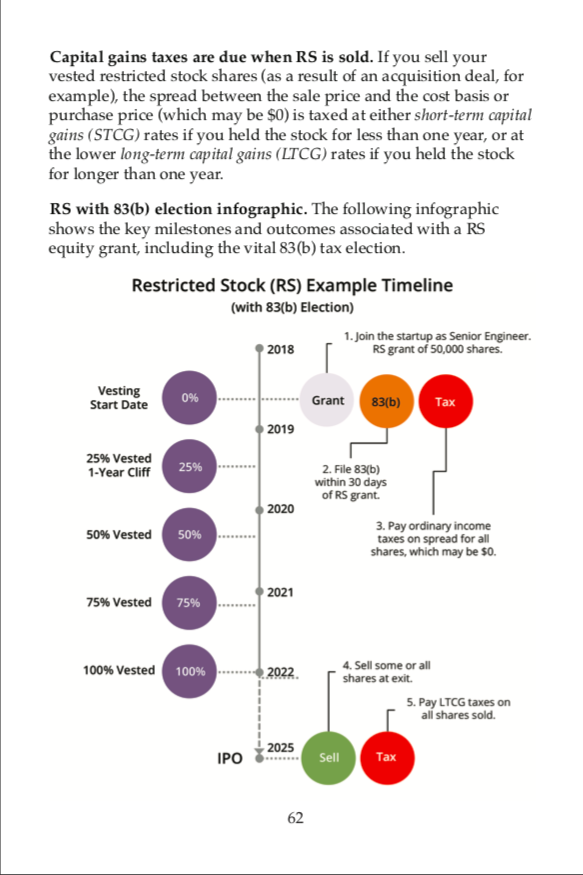

12. The Critical 83(b) Election

- Restricted Stock Taxes—No 83(b) Election Made

- 83(b) to the Rescue: A Few More Examples

- 83(b) Filing Steps5

13. Equity Compensation Types in Detail

- Restricted Stock (RS)

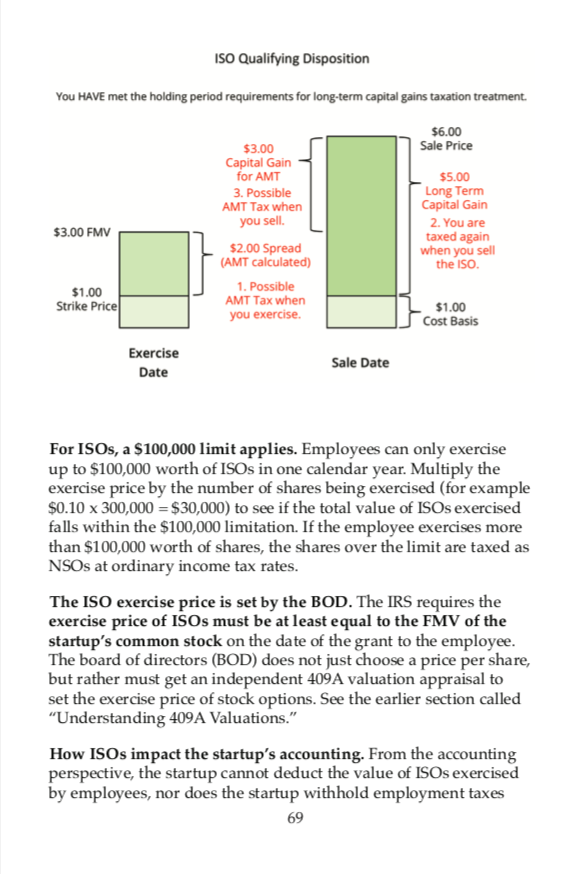

- Incentive Stock Options (ISOs)

- Early Exercise ISOs (EE-ISOs)

- Nonstatutory Stock Options (NSOs)

- Early Exercise NSOs (EE-NSOs)

- Restricted Stock Units (RSUs)

14. Establishing Your Startup’s Equity Plan

- Understanding Who Gets What Type of Equity

- Founders

- Founding Team

- Early Employees

- Later-Stage Executives

- BOD Members

- Advisors and Accelerators

15. Setting Up an Options Plan

- When to Establish an Equity Compensation Plan

- How Big Should Your Options Pool Be?

- Option Pool Size Math

- ISO Stock Plan Requirements

16. Legal Documents and Agreements for Employee Equity

- SEC Rules for Startup Equity Compensation

- Rule 701 of the Securities Act

- Rule 506(b) of Regulation D

17. Choosing Equity Grant Amounts

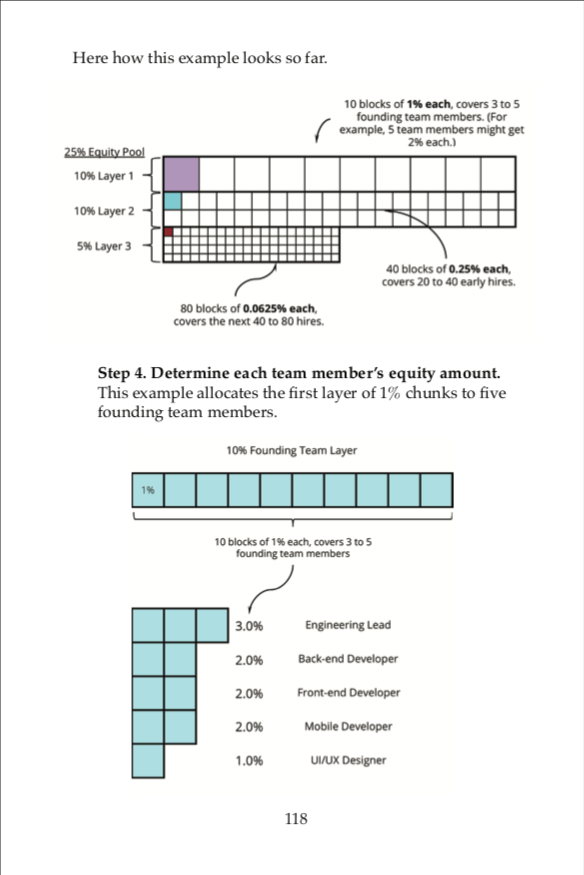

- Hiring Layer Method

- Market Value Method of Allocating Employee Equity

18. Evaluating an Equity Compensation Offer

- Key Info #1: Type of Equity

- Key Info #2: How Much Equity Is Being Offered?

- Key Info #3: Number of FSDO

- Key Info #4: Strike (Exercise) Price of Options

- Key Info #5: Vesting and Acceleration Structure

19. Calculating Your Ownership Percentage and Value

- Scenario : Offered a Quantity of Equity

- Scenario : Offered a Dollar-Equivalent of Equity

- Scenario : Offered a Percentage % of Equity

20. How Large an Exit is Needed for Options to Pay Off?

- IPO Exit

- Merger/Acquisition Exit

- The Liquidity Payout Sequence in an Acquisition

- Using the Exit Value Explorer to Size Up Your Equity

What People are Saying

“Concise and well written.”

C. Widenhooth

Related Books

Startup Valuation

This guide provides a quick reference to all of the key topics around early-stage startup valuation, providing definitions and step-by-step examples for several valuation methods.

Term Sheets

This easy to follow guide helps startup founders understand the key moving parts of an investment term sheet, and review typical preferred share rights, preferences, and protections

Cap Tables

This highly visual guide helps you understand the key moving parts of a startup cap table, reviews typical cap table inputs, and demystifies terminology and jargon associated with cap table discussions.