1×1 Media

Founder’s Pocket Guide: Cap Tables

ISBN: 978-1-938162-07-7

$3.99 ebook

$7.99 paperback

The goal of this guide is to help you understand the key moving parts of a startup cap table, including reviewing typical cap table inputs, and demystifying terminology and jargon associated with cap table discussions. Along the way, this highly visual guide provides easy-to-follow examples for the most common calculations related to cap table building.

Expanding on these key skills every startup founder should know, this Founder’s Pocket Guide helps you learn how to:

- Build your basic cap table step by step, including founder’s shares, option pools, angel investor rounds, and VC rounds.

- Decipher cap table specific lingo, such as fully-diluted shares outstanding, preferred shares vs. common shares, Series A, Series B, and so on.

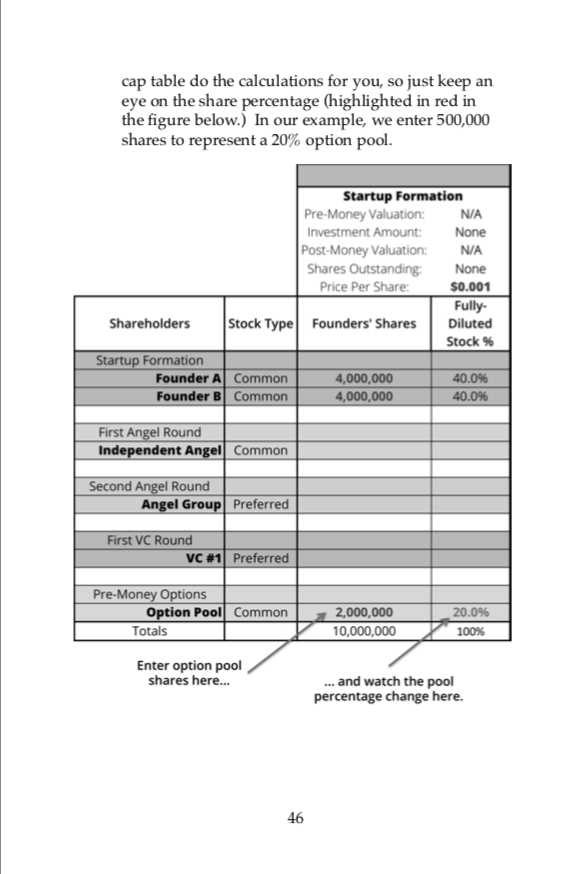

- Establish a stock option pool in your cap table and understand the option pool effect on founder dilution.

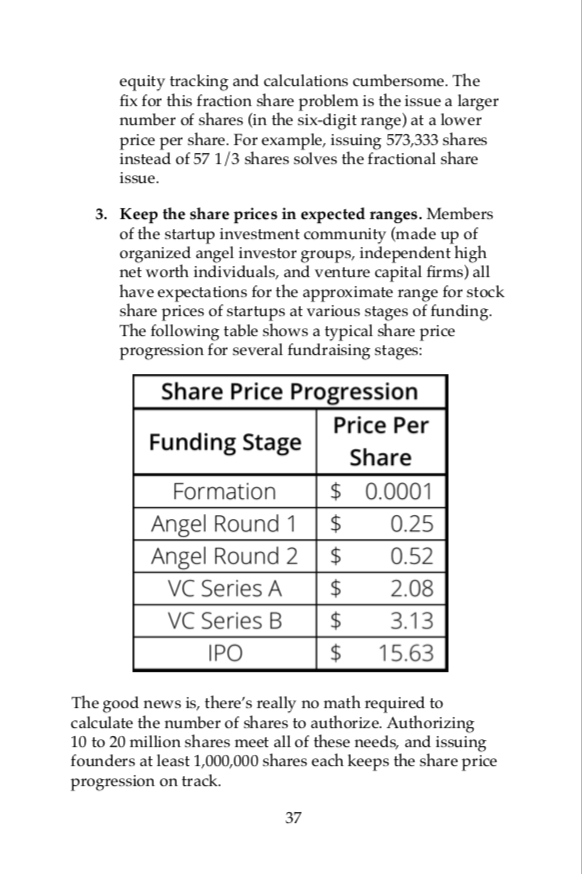

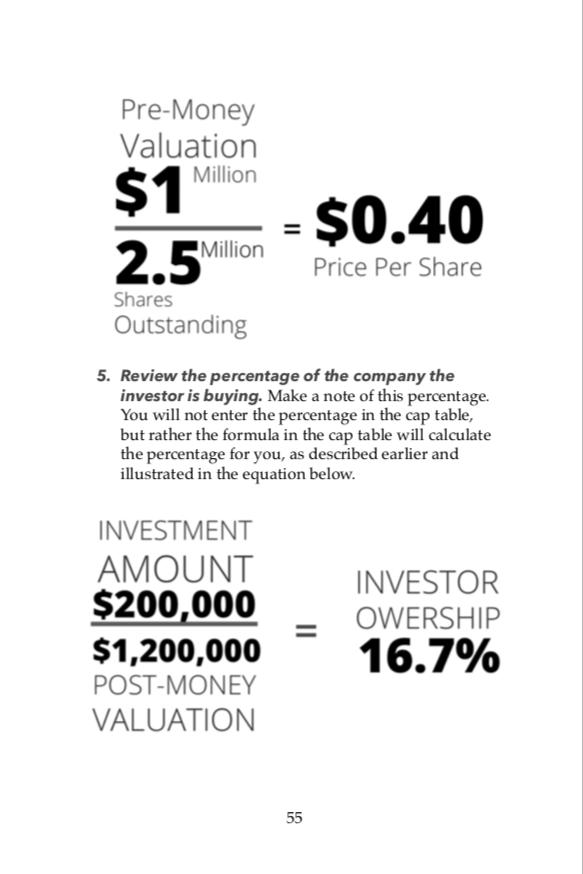

- Understand the simple math behind cap table formulas and calculations, including calculating fully diluted shares outstanding, investor equity ownership percentages, and share price.

Download the Cap Table Companion File

Founders-Pocket-Guide-Cap-Table-Mar-2019.xlsx (16209 downloads )

Table of Contents

1. In This Pocket Guide

- Download Our Example Cap Table File

2. Cap Table Basics

- What Is a Cap Table?

- When To Worry About a Cap Table?

3. Reviewing the Key Sections of the Cap Table

- Shareholders

- Stock Type

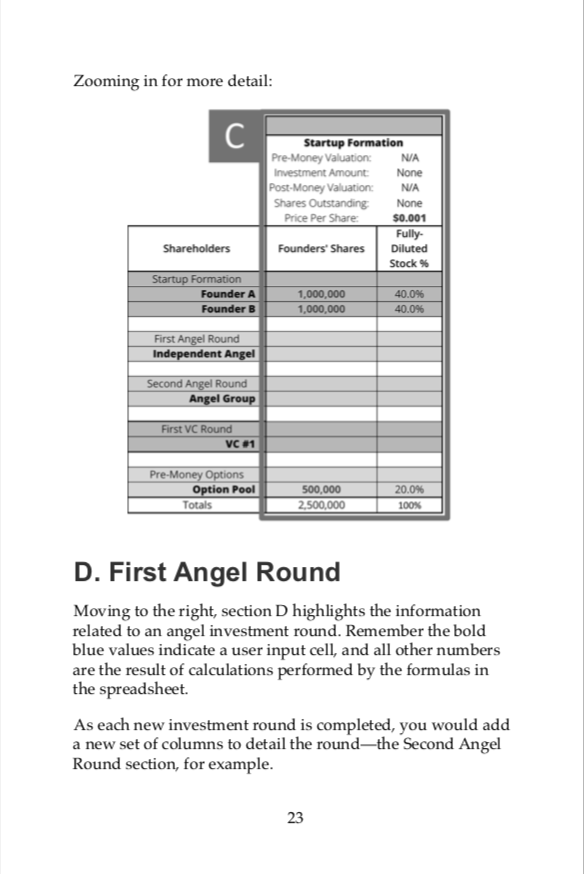

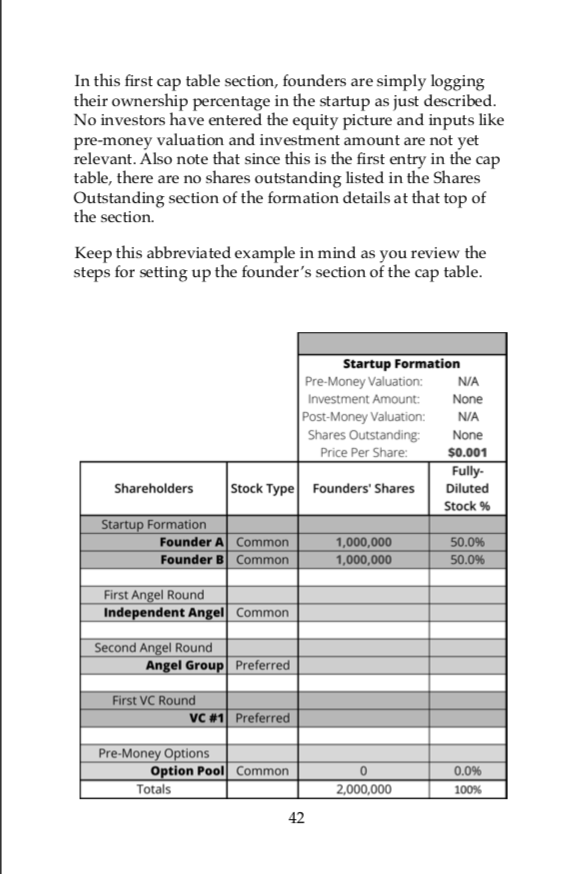

- Startup Foundation (Founders’ Round)

- First Angel Round

- Investment Round Deal Parameters

- Angel Round Shares and Ownership

- Fully-Diluted Stock % (Percentage)

- Option Pool Rows

- Exit Scenario Calculations

4. How to Fill Out A Cap Table Step by Step

- Startup Formation and the Cap Table

- The Formation Round

- Setting Up An Option Pool

- The First Angel Round

- The Second Angel Group

- The VC Investment Round

- Exit Scenarios in the Cap Table

- Tracking Convertible Debt Investments

- Tracking Founder Vesting

- Tracking Warrants

5. Reviewing Supporting Cap Table Concepts

- Startup Funding Terminology

- Pre-Money and Post-Money Valuation

- Fully Diluted Shares Outstanding

- Preferred Shares

- Common Shares

What People are Saying

“Great resource”

Dean D.

“Great beginner guide to cap tables”

A.C.

“Five stars”

Greg C.

Related Books

Startup Valuation

This guide provides a quick reference to all of the key topics around early-stage startup valuation and provides step-by-step examples for several valuation methods.

Term Sheets

This easy to follow guide helps startup founders understand the key moving parts of an investment term sheet, and review typical preferred share rights, preferences, and protections

Stock Options

This highly visual guide offers startup founders and employees a “nuts and bolts” view of how stock options and other forms of equity compensation work in early-stage startups.